Guidelines for stamp duty relief. Please input the tenancy details and then press Compute.

How Important Of Stamping The Tenancy Agreement Dr Homesearch

The person liable to pay stamp duty is set out in the Third Schedule of Stamp Act 1949.

. In other words the balance you need to pay is. The amount of stamp duty currently payable on the instrument will be shown. The exemption applies for a maximum loan amount of RM300000.

Total exemption amount is. Total Stamp Duty to be paid is. The tenancy agreement between the landlord and the tenant has to be executed and stamped for coming into effect on or after 1 January 2018.

Stamp duty exemption on any instrument in respect of the issuance guarantee and services in relation to the issuance of the Bonds which is executed between 26 February 2019 and 31 December 2019 pursuant to the Stamp Duty Exemption Order 2019. You will also need to pay stamp duty on your loan agreement based on a flat rate of 05 of the total loan. Above RM500 000 RM3000.

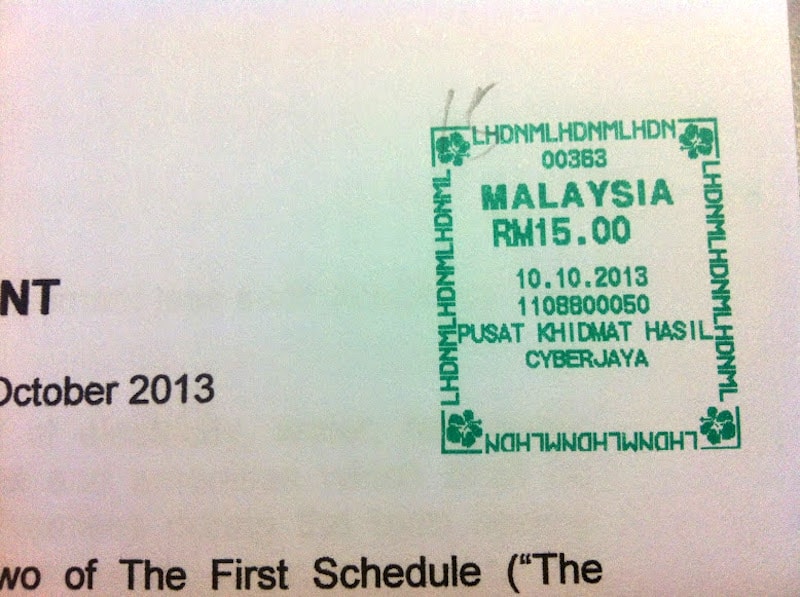

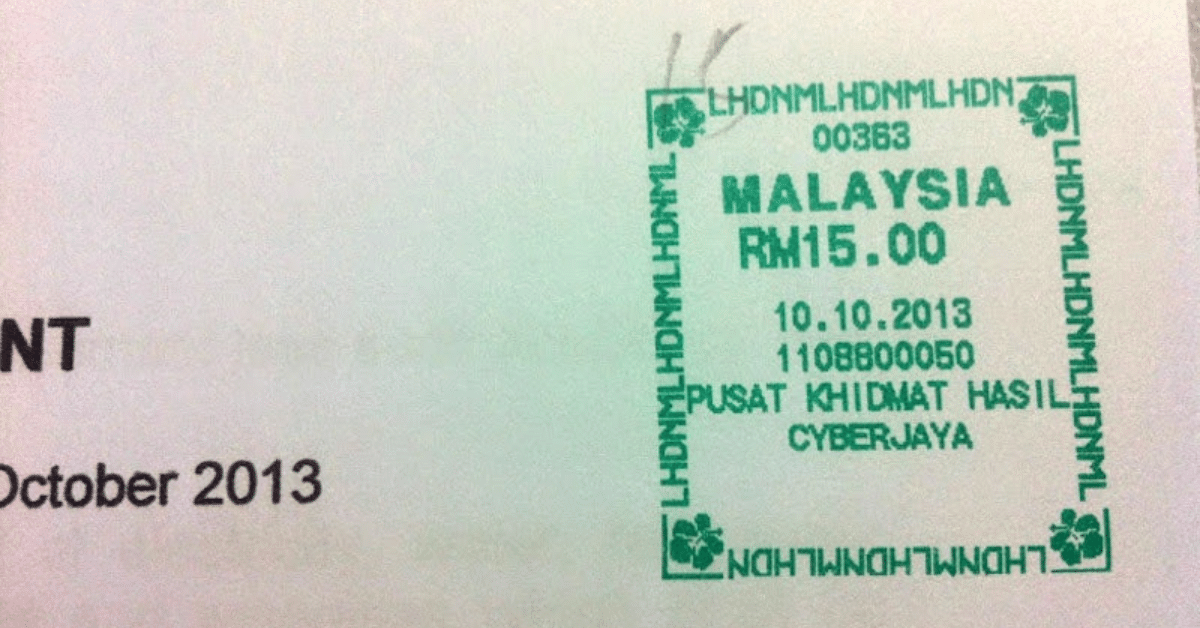

You may contact our panel lawyers the author of this article. The Price for every RM 250 per rent in a 1 to 3 years tenancy agreement. The Inland Revenue Board of Malaysia IRBM issued two 2 technical guidelines available in Bahasa Malaysia only dated 26 January 2019 for application of stamp duty relief under Section 15 and Section 15A of the Stamp Act 1949.

The Web App below will assist you to calculate Stamp Duty Payable Legal Fee Payable and estimated Admin Fee Payable. It is for your. First RM 10000 rental 25 of the monthly rent.

Just use your physical calculator. 1 Guidelines for Application on Relief from Stamp Duty under Section 15 of the Stamp Act 1949. Legal Fee for Tenancy Agreement period of above 3 years.

The Calculation is base upon Monthly Rental and period of Rental signed in the Tenancy Agreement. Shares or stock listed on Bursa Malaysia. Stamp duty Fee 1.

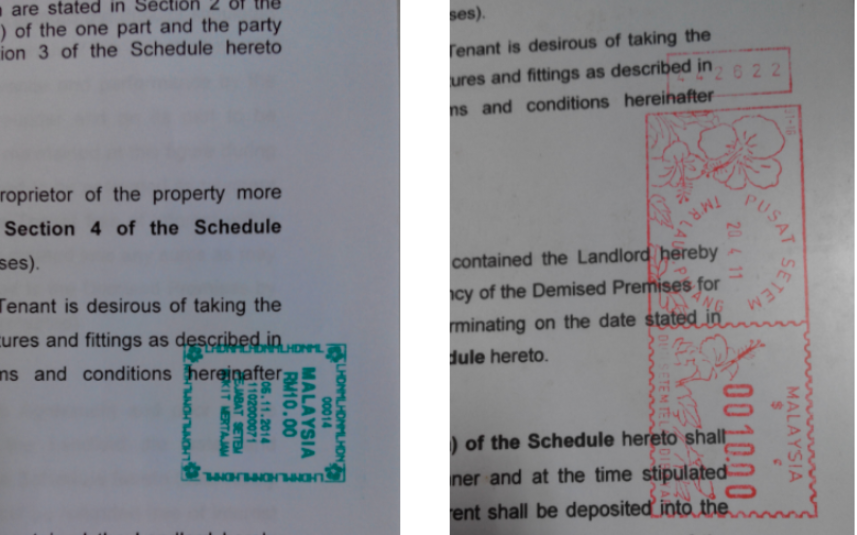

When we signed a tenancy agreement in Malaysia the Tenant is required to pay Stamp Duty as a form of tax to the government. The sale or transfer of properties in. The standard legal fees chargeable for tenancy agreement are as follows-.

Since 2019 till now we are providing the Stamp Duty runner service for Property RentalTenancy Agreement. What should I do if the tenant has damaged the furniturefixtures of my property. More than RM 100000 negotiable.

Can I enter the premises without the tenants permission. The Price for every RM 250 per rent in a 1 year tenancy agreement. Next RM 90000 rental 20 of the monthly rent.

Stamp Duty Computation Landed Properties - Tenancy Agreement. Stamp duty Fee 3. First RM 10000 rental 50 of the monthly rent.

You dont need a loan stamp duty calculator to calculate this. RM 12000 RM 5000 RM 7000. Stamp duty Fee 2.

Stamp duty of 05 on the value of the services loans. Property Stamp duty. The stamp duty is free if the annual rental is below RM 2400.

Service Agreements and Loan Agreements. If the loan amount is RM300000 the stamp duty for the loan agreement is RM300000 x 050 RM1500. Rental Stamp Duty Tenancy Agreement Runner Service.

For First RM100 000 RM1000. The tax includes stamp duty on the Sale and Purchase Agreements SPA of your property and stamp duty for the Memorandum of Transfer MOT both of which are calculated based on the purchase price. The amount of the current stamp duty payable is computed according to the information that you have entered.

RM100 001 To RM500 000 RM8000. An instrument is defined as any written document and in general- stamp duty is levied on legal commercial and financial instruments. The Assessment and Collection of Stamp Duties is sanctioned by statutory law now described as the Stamp Act 1949.

Malaysia only on 26 February 2019 to provide guidance in the application of stamp duty relief. The loan agreement Stamp Duty is 050 from the loan amount. RM 2 for every RM250 of the annual rent above RM2400.

RM 1 for every RM 250 of the annual rental above RMM 2400. Can I renew the tenancy agreement or should I make a new tenancy agreement if I want to renew my tenancy. RM1 for every RM1000 or any fraction thereof based on the transaction value increased to RM150 for every RM1000 or fractional part of RM1000 wef.

Income tax exemption on interest income and technical services fee.

If A Tenant Damages Your Property In Malaysia Asklegal My

Tenancy Agreement Charges And Stamping Fee Calculation In Malaysia

Tenancy Agreement In Malaysia Complete Guide And Sample Download

Tenancy Agreement In Malaysia Complete Guide And Sample Download

Tenancy Agreement In Malaysia The Ultimate Guide Speedhome Guide

Tenancy Agreement In Malaysia Complete Guide And Sample Download

Pin By Blackdoom Sri Mayangkala On Azylia Collection Being A Landlord Perlis Tenancy Agreement

Tenancy Agreement Pdf Leasehold Estate Landlord

How Important Of Stamping The Tenancy Agreement Dr Homesearch

Format Of Board Resolution For Taking Premises On Lease

Rental Agreement Stamp Duty Malaysia Speedhome

How To Calculate Tenancy Agreement Stamping Fee

Pdf Joint Tenancy In The Islamic Law And Its Application In Malaysia

Tenancy Agreement In Malaysia The Ultimate Guide Speedhome Guide

Early Termination Of Tenancy Agreement How Why And What Does It Mean

Tenancy Agreement In Malaysia The Ultimate Guide Speedhome Guide

Tenancy Agreement In Malaysia Complete Guide And Sample Download

Tenancy Agreement In Malaysia Complete Guide And Sample Download